IOTA Manifesto: The World Onchain

TL;DR:

IOTA is moving beyond crypto’s credibility gap, focusing on bringing the real world onchain through trusted, regulated, and scalable infrastructure. Rather than competing in saturated crypto niches, it is creating a “Blue Ocean” market where real-world data, assets, and identities are tokenized and transacted onchain – starting with Global trade, a $35 trillion sector, with vertical integration spanning digital identities to tokenized trade finance already underway through initiatives like TWIN.

Blockchain is a uniquely difficult market to operate in. The typical challenges every startup faces – attracting the best talent, finding product market fit, securing funding – are amplified to violent extremes by a fiercely unpredictable boom and bust cycle, misaligned incentives and speculative value creation (and extraction). It is a wild ride on an emotional rollercoaster that takes you to new heights of euphoria and excitement, and drops you to the depths of despair and existential crises.

We’ve all witnessed a graveyard of failed tokens, "heroes" who fell from grace to prison, and too many scams that have left retail investors devastated (and penniless). These failures have not only cost billions, but have left the reputation of the entire industry tarnished.

For those of us trying to build something real for the long-term, navigating this environment has required resilience and perseverance. Idealistic visions have repeatedly been shattered with speculative excesses and the irrational behavior of the markets. The only way to endure in this market is through conviction.

Despite all of this, I have spent close to 15 years of my life working full time in this market. There is simply no other technology ecosystem that offers as profound an opportunity to fundamentally transform our society and economy.

For me, the conviction is clear: Crypto is already changing the world, and the adoption and impact will only accelerate. It is as significant a technology revolution as the Cloud and AI are. With Blockchain and a global community of the brightest minds and innovators, we are finally building the "world as it ought to be" for everyone. We are removing the centralized gatekeepers and replacing them with a neutral, permissionless digital infrastructure where individuals can claim their digital sovereignty and participate in a global, digital economy.

Ten years ago, we began this journey with IOTA based on a singular vision: To bring the real world onchain. While it’s certainly been a wild and chaotic ride, we’ve moved past speculation and experimentation and into real adoption and impact. Over the past several years, we’ve progressed from experimentation to deployment, with IOTA now supporting real-world use cases at a scale.

- Launched late last year, in partnership with the AfCFTA Secretariat, World Economic Forum and the Tony Blair Institute for Global Change, the Africa Digital Access and Public Infrastructure for Trade (ADAPT) initiative is our boldest adoption effort to date. Through ADAPT, we are building the digital backbone for trade in Africa, connecting identity, data, and finance across an entire continent.

- Building on the success of the Trade Logistics Information Pipeline (TLIP) in East Africa – which has already proven it can reduce border clearance times from weeks to days – the Trade Worldwide Information Network (TWIN), built on IOTA, is now scaling globally. These are not pilots. They are production-ready systems digitizing millions of documents and securing the flow of physical goods on the IOTA Mainnet.

- Our partnership with Salus brings transparency to critical mineral supply chains, helping address the multi-trillion dollar global trade finance gap.

- Through the RESULD initiative (Responsible Supply Chains and Logistics Due Diligence), we break down barriers to the global market by digitalizing end-to-end fruit and vegetable supply chains between Kenya, the Netherlands, and the United Kingdom.

- In parallel, we’ve expanded our market reach through integrations with core Web3 infrastructure providers like BitGo, Uphold, LayerZero, Stargate, and Turnkey, enabling IOTA to be accessed, integrated, and used across the globe.

Our next phase is clear: The world is moving onchain. And we’re working tirelessly with one of the most experienced teams in this space, one of the most advanced technology stacks, and an international partner ecosystem to make IOTA the largest, most trusted public digital infrastructure for the global economy.

In this manifesto, I’m setting out the vision and strategy of IOTA for 2026 and beyond.

IOTA’s Vision: The World Onchain

I have no doubt that within a decade our $115T global economy will operate onchain. We will finally be able to grow beyond the borders of our analog world and unlock new ways for people to connect, work, and create value together.

Humanity’s path to prosperity and abundance depends on making Artificial Intelligence (AI) and Blockchain (Digital Trust) globally accessible. Together, they form the brain and nervous system of the digital world: AI driving intelligence, automation, and creation, while Blockchain ensures trust, authenticity and auditability in every interaction. By combining these two foundational technologies we can build a truly connected, intelligent and digital world.

Trust is the foundation of our economy. The only way to ensure that our economy will grow globally is through a neutral, censorship-resistant, and publicly accessible digital infrastructure. We need programmable trust to authenticate and verify data at internet speed, instant and secure payments to move value around the world without intermediaries, and secure compute for immutable and unstoppable applications. Only through Blockchain are we able to stop relying on centralized intermediaries and inefficient and error-prone processes to establish a single source of truth.

Blockchain is an obvious progression in the technology evolution that has started with the Cloud and has continued with the rapid advancement of AI. Both technologies have permeated through every layer of our society and economy. The Cloud has enabled us to digitalize the world by providing the infrastructure for data to be stored, analyzed and transferred around the globe in real-time. The AI race towards superintelligence has created a globally accessible, ubiquitous intelligence layer that has made new applications and services accessible to anyone, providing a significant boost to productivity and efficiency.

Today, governments and enterprises spend more than $723 billion on cloud computing annually, with annual growth projected to be more than 20%. Amazon Web Services alone has reached a $120 billion annual revenue run-rate as the market leader. Simultaneously, the broader AI-enabled digital economy is on track to rival the Cloud itself. The entire AI market from hardware to software and services has grown exponentially and is expected to reach $900 billion annually in 2026. Valuations of the five most valuable private AI startups - led by OpenAI, Anthropic and xAI - have ballooned to nearly $1.2 trillion by end of 2025, and are climbing further.

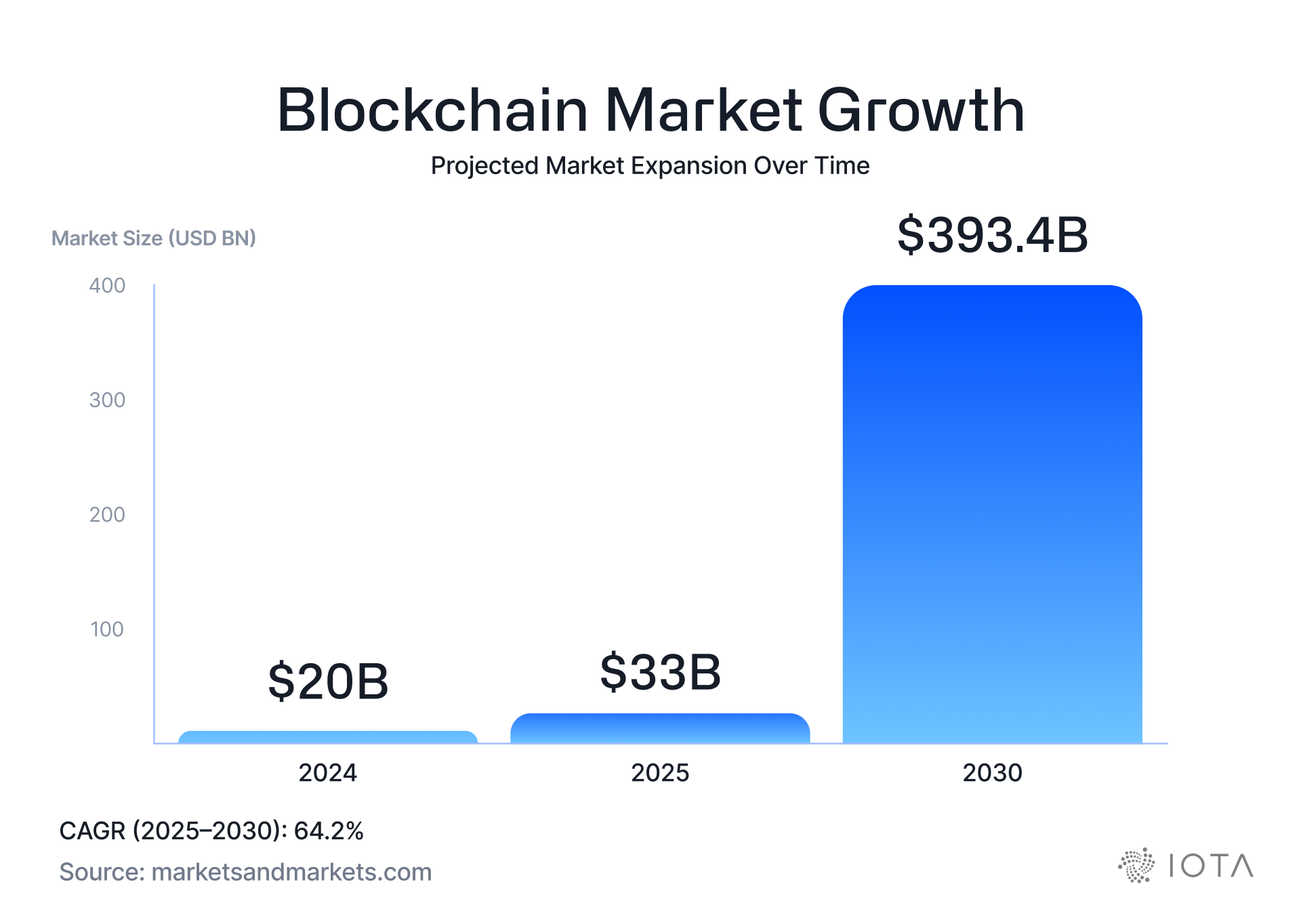

While Blockchain is a much younger technology, the market will continue to grow rapidly over the coming years to match both the Cloud and AI in importance, adoption and revenues. By 2030 it is expected that $393 billion will be spent yearly on Blockchain networks to access digital payments, trading infrastructure, digital identities, finance, asset tokenization, and many more applications.

Blockchain will not be a winner-takes-all market. The global economy is simply too big for one network to dominate all industries and applications. While most Blockchain networks that lack a clear purpose with unique selling points and adoption cases will fade into obscurity, a handful of Blockchain networks will dominate the market, many of which will be focused on different economic sectors and applications – similar to today’s four or five dominant cloud providers (AWS, Google Cloud, Azure, and Oracle) or large-scale AI LLM providers (OpenAI, Anthropic, Gemini, xAI). The value that will be captured by a handful of Blockchain networks that dominate this market will be as great as in the AI and Cloud sectors, with hundreds of billions of dollars in revenues spent on transaction fees and compute per year.

The biggest opportunity in the market is to become one of the primary Blockchain networks to bring the real world onchain.

This is why IOTA exists.

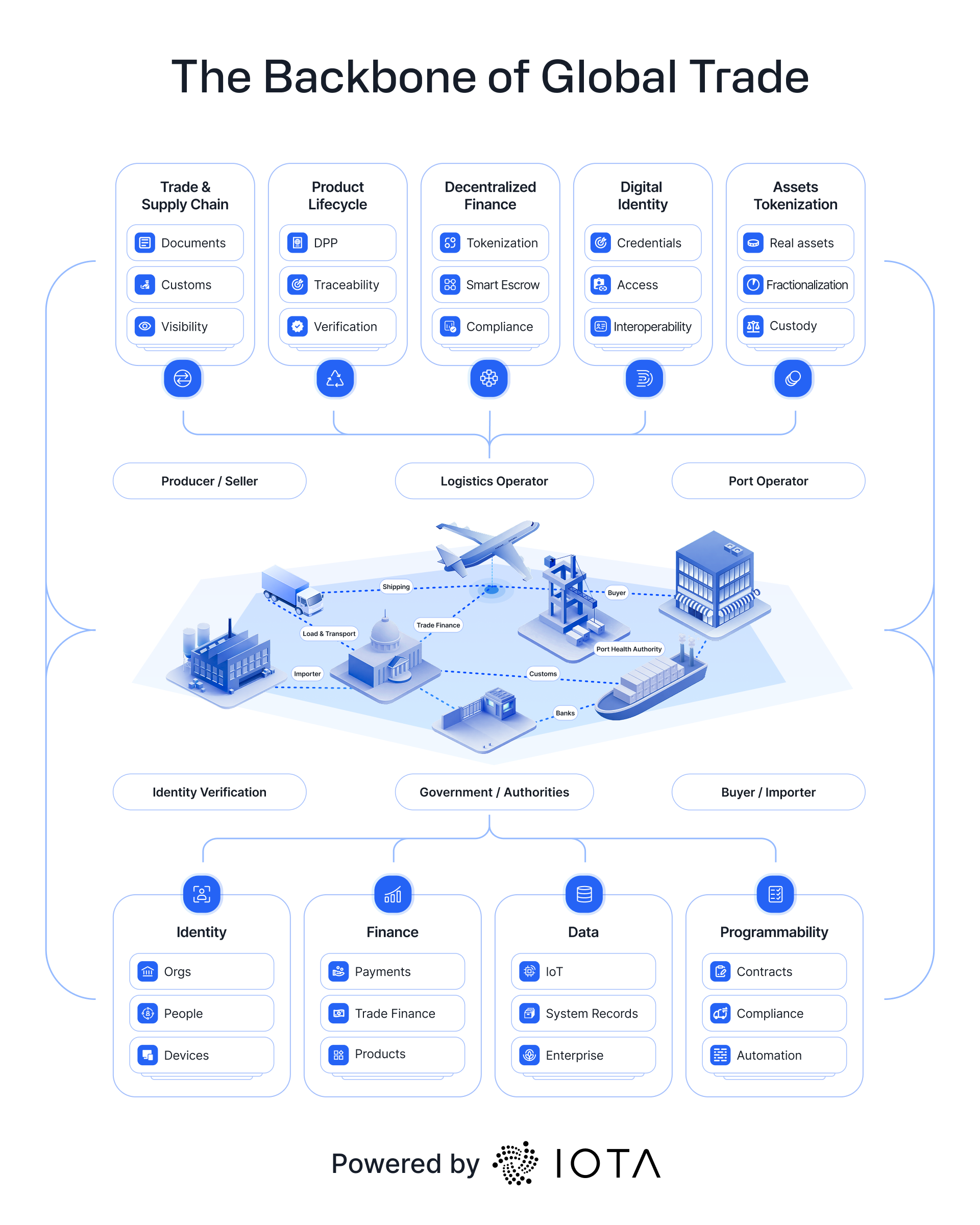

To realize this opportunity with IOTA, we are leveraging our decade-long experience and strong reputation in the market, to pursue full vertical integration in one of the largest sectors of our global economy: International Trade & Logistics. Over the last few years we have created the solutions, products, and partnerships to deeply embed IOTA into the entire trade sector, from tracking shipments and digitizing paperwork, issuing digital identities and verifiable credentials, to tokenizing physical assets and powering trade finance.

To Conquer the World, First Conquer a Market

Instead of seeding general-purpose adoption and playing the typical crypto game of hype, speculation, and incentives, we have been focused on finding product-market fit, creating practical solutions for the real world, and building a defensible moat by becoming fully vertically integrated in international trade.

International trade in goods and services was more than $35 trillion in 2025 – roughly one third of global GDP. Global trade is the lifeblood of the world economy and involves every country, millions of companies, and billions of end consumers. Yet it remains stuck in the past, as the systems, technologies, and processes underpinning our flow of goods are often shockingly antiquated and archaic.

Just to give a glimpse of the persisting problems in trade:

- 4 billion trade documents are in circulation on any given day. To track the shipment of physical goods, every single trade involves up to 30 individual entities with over ~36 documents and ~240 copies exchanged around the world.

- The cost overhead of every cross-border trade can reach 20%, and includes handling all the paperwork, complying with redundant procedures, and delays incurred because of manual processing, human errors and missing information. (Fun fact: To solve this problem and revolutionize trade, DHL was founded in 1969 with the mission to transport paper documents around the world, ).

- $2–5 billion is lost by banks and traders every year due to forged or duplicated trade documents, such as invoices, bills of lading, and warehouse receipts. Beyond direct losses, these error-prone processes handling physical paper documents enable hundreds of billions in trade-based money laundering and hundreds of billions more in counterfeit goods moving through global supply chains.

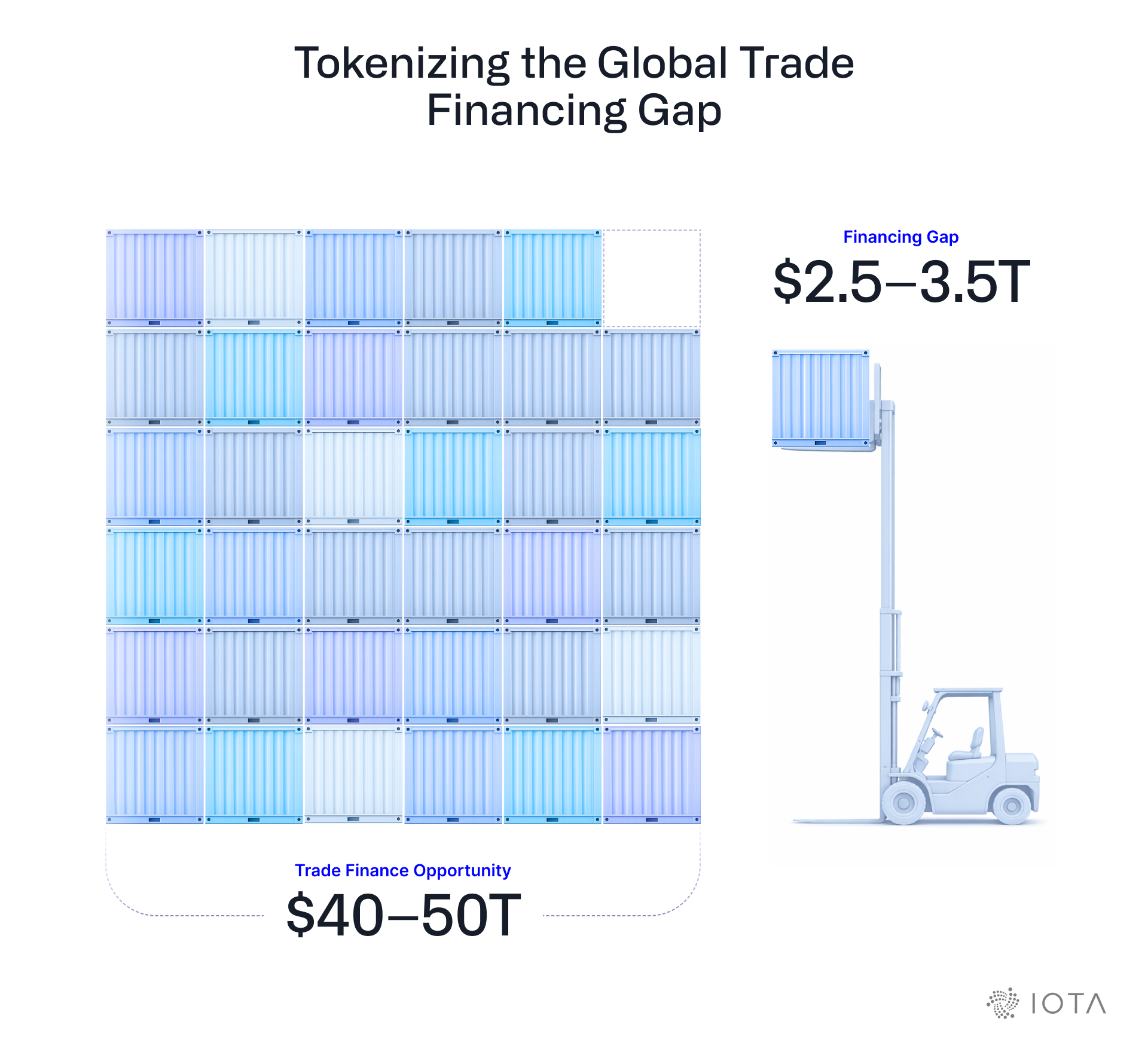

- There is an annual $2.5 trillion funding gap in trade finance. The vast majority of global trade relies on financing to solve short-term liquidity gaps, as payment terms of buyers can sometimes reach up to 90 days after the cargo has arrived. Despite its enormous size and importance to the global economy, there is a significant funding need that banks and other financial institutions are unwilling or unable to meet, forcing reputable traders to pay astronomically high interest payments or receive no financing at all.

Considering these rampant inefficiencies, the increasing coordination challenges between multiple parties and different jurisdictions, and the vast complexities that make up today’s cross-border trade system, there is a clear need for a solution. Trade in 2026 should not be reliant upon pieces of paper being shipped around the world to clear customs, export goods, or provide financing.

Thanks to the Model Law on Electronic Transferable Records (MLETR), since 2017, a large number of countries have given full legal acceptance to electronic transferable records (e.g., electronic bills of lading, warehouse receipts, promissory notes). This means that digitized documents are as valid as their physical paper equivalent, enabling these documents to be generated, transferred, and tokenized in a fully digital form.

The roadblocks preventing trade digitalization aren’t related to technology, regulation or laws; it’s about acceptance and integration. No single government or company can mandate a global solution, which is why past attempts often failed to gain critical mass. The only way to digitize cross-border trade is through a neutral infrastructure that establishes an indisputable global truth that the actors in the system want to adopt because they profit from it by removing complexity and inefficiency, instead of it being mandated by an authority without the power to change the system as a whole. Instead of being for-profit oriented, it has to be non-profit, open-source, and governed by independent parties.

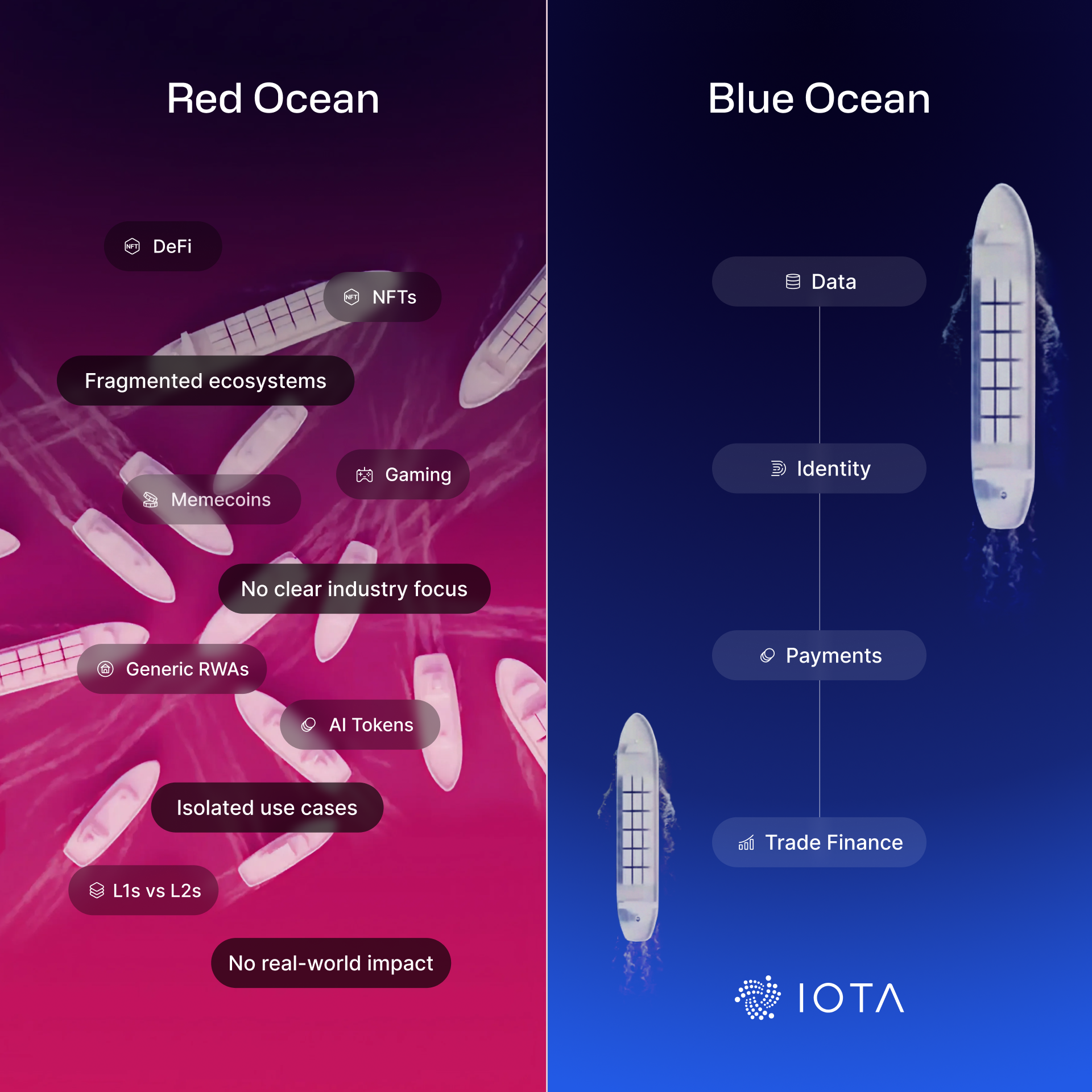

Global trade has remained largely uncharted territory for Blockchain adoption. This is precisely why we see it as our Blue Ocean opportunity.

IOTA’s Blue Ocean Opportunity: The $35 Trillion Trade Sector

Big‑picture, IOTA exists to bring the real world onchain by building the global infrastructure where trillions worth of assets will be tokenized, exchanged, and settled. While that vision will unfold in the next five to 10 years, we’re taking the most important step now by establishing IOTA as the Blockchain network for global trade. Through this vertical integration, IOTA will bring boundless economic activity onchain – in the form of trade digitization, physical asset tokenization, data sharing, certifications, and more – and our technology will be deeply embedded into the existing systems of governments and enterprises. Once this foundation is established and proven at scale, we can extend the same rails across adjacent industries and, ultimately, our entire global economy.

This is IOTA’s Blue Ocean opportunity.

A Blue Ocean strategy creates new, uncontested markets where competition is irrelevant, while a Red Ocean strategy competes aggressively within existing, crowded markets.

Consider the upside here: even just a 5% efficiency gain in global trade via digitalization will unlock hundreds of billions of dollars in economic value. The demand for a solution to digitize trade and solve many of the problems related to trade finance are enormous. As the World Economic Forum reported, IOTA’s trade technology and the initiatives of TWIN (more details below) have the potential to reduce global trade costs by 25% and create new economic opportunities for developed and emerging markets.

I firmly believe that the work we do at IOTA to digitize global trade will lead to a direct increase in global GDP. More trade, lower costs, lower entry barriers, more market entrants, more financing, and more economic growth.

At the IOTA Foundation, we’ve been working in the global trade & supply chain market since 2018 and, in recent years, have increasingly stepped up our investment and focus. With the success that we’ve seen with TWIN and its adoption across Africa and Europe, we are fully committed to making sure that IOTA becomes the Blockchain network for global trade.

Today, IOTA has no large competitor in this market and is largely unchallenged when it comes to digitizing trade.

The biggest competitor in the past, the IBM/Maersk platform TradeLens, tried a top-down approach but couldn’t onboard a sufficient share of the industry due to conflicts of interest (who wants to join the permissioned Blockchain of your competitor?) and misaligned incentives (owning and monetizing the infrastructure, rather than solving problems together with their customers). After hundreds of millions in investments, the initiative was discontinued after failing to reach commercial viability.

Proof: TWIN and Live Adoption

Trade related adoption is already happening on IOTA. The earliest application was with TLIP in Kenya, developed in 2019 in partnership with TradeMark Africa and the Kenyan government. Kenya’s single-window customs platform (KenTrade) was fully integrated on IOTA, with a pilot running in Kenya’s flower export industry (seven million flower stems exported per day) in partnership with Trademark Africa to demonstrate the efficiency gains.

As a result of these early successes in proving the technology in real-life pilots, we have worked together with our partners to launch a production-ready version – TWIN (Trade Worldwide Information Network), which is IOTA’s flagship application to digitize and modernize global trade.

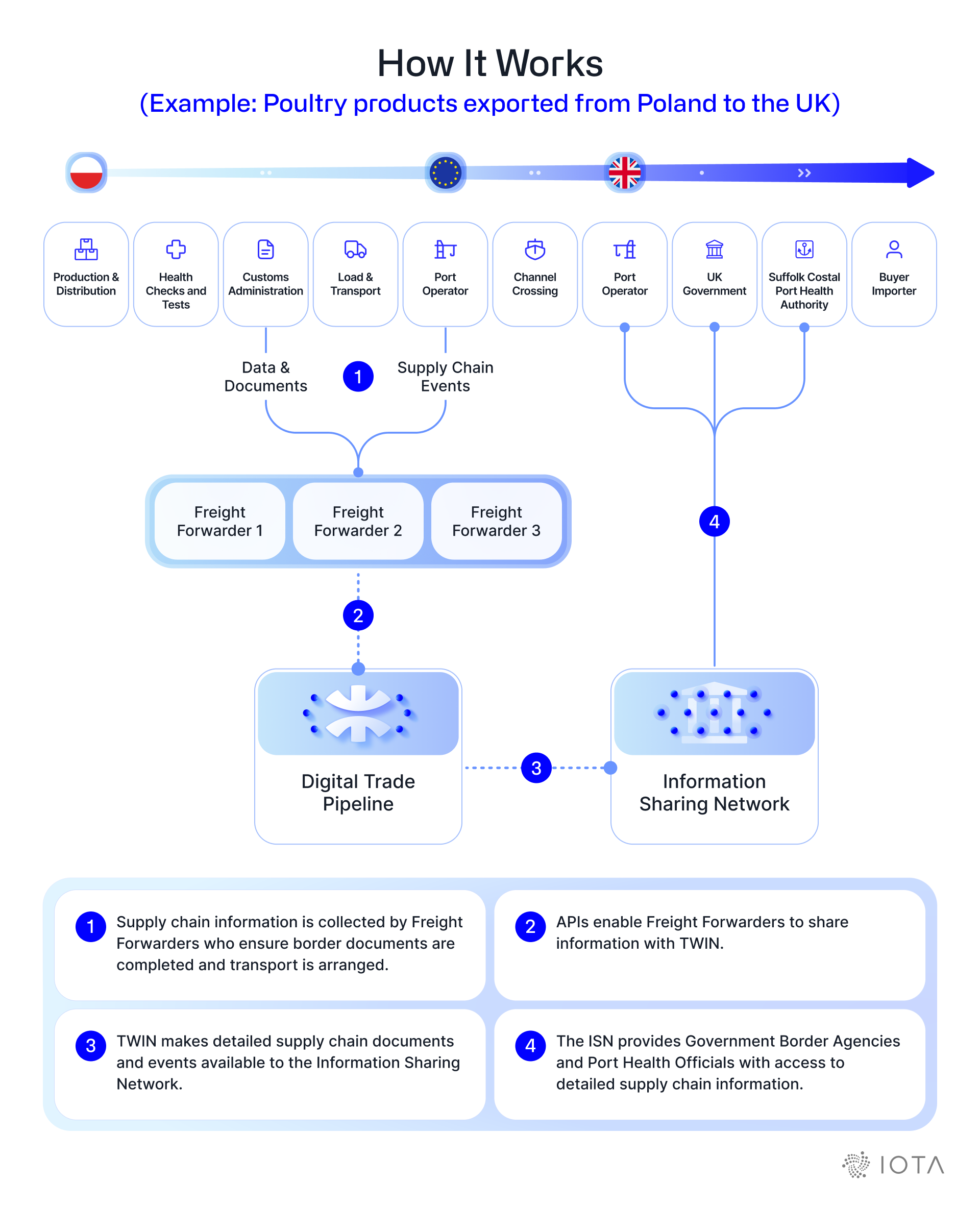

Built on the IOTA mainnet, TWIN replaces the paper-based, fragmented systems that underpin the global trade industry with a unified, verifiable, and trusted digital infrastructure. It enables governments, enterprises, and logistics providers to issue verifiable credentials, track shipments as tokenized NFTs to seamlessly exchange trade data across borders – all in real time, secure, at near-zero cost, and with full auditability. By turning physical documents and goods into onchain assets, TWIN creates the foundation for digital trade, unlocking faster customs clearance, lower shipping costs, and new financing opportunities for millions of businesses worldwide.

Today, TWIN is already live in Kenya’s trade system. Currently limited to primarily flower traders, but by end of Q1 it is expected to roll out to all commodities. This means that flower traders in Kenya already have access to fully digitized trade documents through the IOTA network. In the UK, the Cabinet Office’s Border Strategy team has piloted TWIN to streamline UK-EU freight: over 2,000 poultry consignments from Poland to the UK were tracked on IOTA in 2024–2025, providing real-time visibility, better quality data earlier in the process, and smoother border operations. Four employees of the UK Cabinet Office have been seconded to IOTA to expand the trials in close collaboration with the UK government, and plans are made to include more EU countries with a wider range of consignments.

Since early January 2026, TWIN is now fully integrated with the IOTA mainnet. This means that the first customers that have been using TWIN to digitize their consignments are now fully operational on the IOTA mainnet. The first transactions are already live, with a rapid increase in transactions expected throughout 2026 as TWIN gets rolled out in Kenya, Ghana, the UK and more partner countries.

The ADAPT initiative (Africa Digital Access and Public Infrastructure for Trade) represents the most significant adoption milestone in IOTA’s history, marking a transition from regional pilots to true continental scale. Led by the AfCFTA Secretariat in partnership with IOTA, the Tony Blair Institute for Global Change, and the World Economic Forum, ADAPT is Africa’s blueprint for the modernization of trade through a unified digital public infrastructure. This initiative aims to connect all African nations and 1.5 billion people by 2035, creating a single source of truth for identity, data, and finance that has the potential to double intra-African trade and unlock over $70 billion in additional annual trade value. By integrating IOTA’s decentralized ledger as the underlying backbone, ADAPT replaces fragmented, paper-based systems with a trusted digital architecture that can cut border clearance times from 14 days to hours and reduce cross-border payment fees by more than 50%.

Adoption is accelerating globally. Over the next 12 months, we will start pilots with at least five more countries across Africa, Europe, Southeast Asia, and North America – officially connecting more countries and their trade infrastructure onto IOTA. By 2030, we foresee that TWIN will be adopted in over 30 countries. Each new country that joins TWIN expands the reach and utility of the TWIN platform and increases its network effects, bringing us closer to a truly interconnected digital trade infrastructure.

Multiply that by millions of transactions across thousands of corridors across the globe. We’re building the digital global nervous system for trade. IOTA will connect national single windows, port systems, logistics platforms, and financial institutions in a way that no centralized system could, because it is trust-minimized and neutral. It’s akin to how SWIFT provided a messaging network for banks – but here we provide data and value transfer for the entire global supply chain. IOTA will eventually become so embedded that it’s simply part of the fabric of trade (much like the internet or GPS are today). Countries would connect their systems to the “global trade network” (IOTA) much like they connect to the internet. Not doing so would leave them isolated.

IOTA bridges the physical and digital worlds by bringing data, assets, and identities onchain. Instead of creating speculative or valueless tokens, we’re tokenizing real-world assets – from commodities and critical minerals to trade receivables and warehouse receipts – and make them available in purpose-built DeFi applications and stablecoins built on IOTA. This creates an entirely new class of decentralized financial applications that are backed by real assets generating real yield.

Several applications expanding IOTA’s trade ecosystem beyond TWIN are already deployed on the IOTA mainnet.

Redefining Circularity: Orobo has launched a regulation-ready infrastructure for Digital Product Passports (DPPs), designed to meet the EU’s strict Ecodesign requirements. Among its several customers is Dutch construction company Re-Use Properties, which has started issuing Steel Frame DPPs on the IOTA Mainnet.

- Mainnet Proof: Check out the IOTA Identity that represents Re-Use Properties and one of their Steel Frame DPPs.

Closing the $2.5 Trillion Trade Finance Gap: Salus is revolutionizing how we finance the critical minerals essential for the green transition. By leveraging IOTA and TWIN, Salus tokenizes physical assets (such as tantalum), turning them into auditable digital assets that funders can trust. This provides institutional-grade transparency and brings real-world yield opportunities to the IOTA ecosystem.

- Mainnet Proof: View the NFT representing 0.5 tons of Tantalum

Tamper-Proof Product Tracking: In the broader scope of product authenticity, ObjectID is setting a new standard for onchain verification. By assigning tamper-proof digital identities to physical goods, they ensure end-to-end visibility and security across complex supply chains. Their recent launch of onchain verified products, such as for Lizard Medical, showcases how IOTA turns physical objects into verifiable smart assets accessible via a simple QR scan.

Bringing Global Standards OnChain: Our partnership with the Global Legal Entity Identifier Foundation (GLEIF) is a landmark step in institutional integration. By exploring how to bring global digital business identifiers onto the IOTA network via TWIN, we are creating a unified, trusted identity layer that allows organizations to interact and trade with total cryptographic certainty.

The Impact of Trade Adoption on IOTA

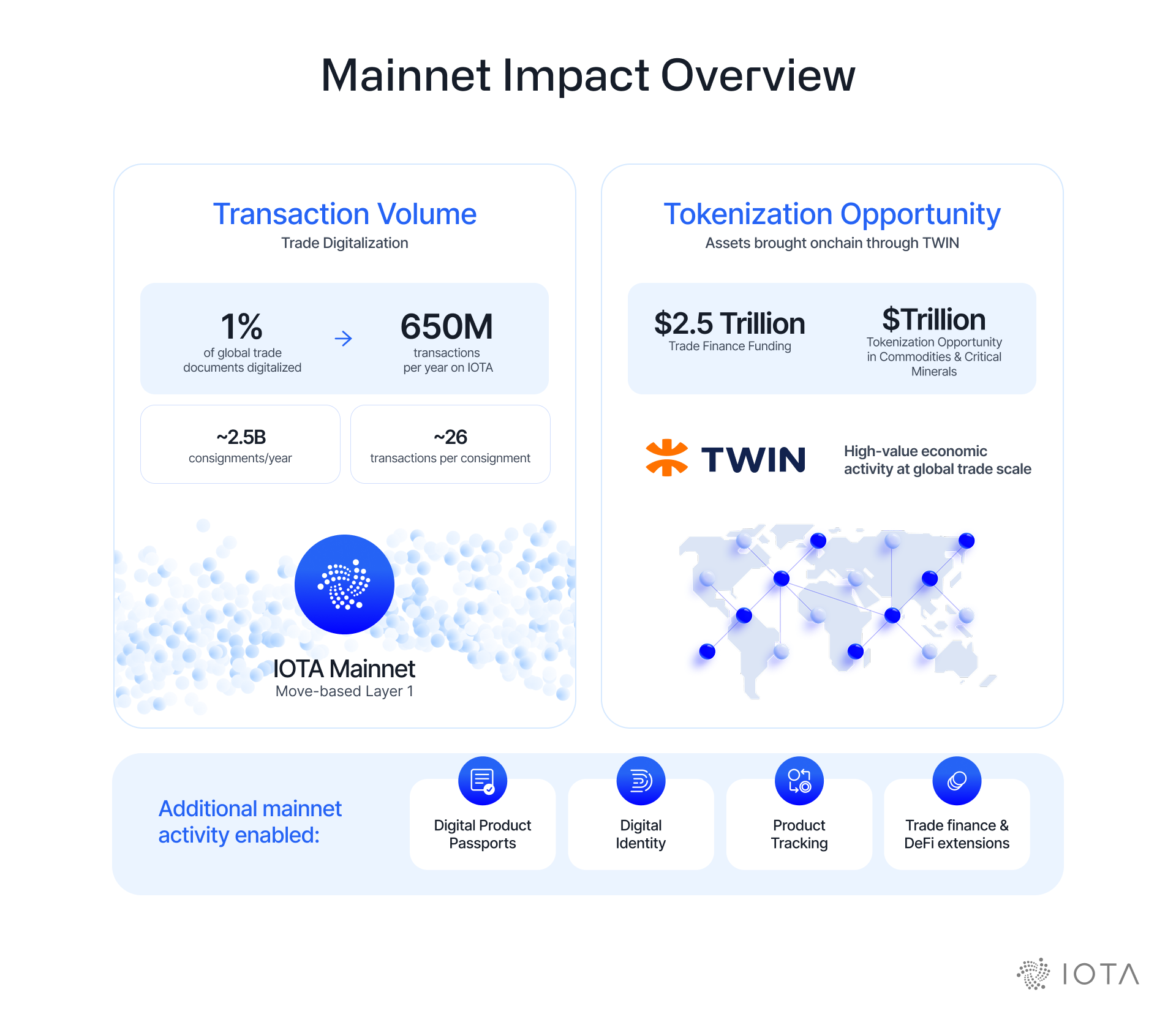

While it is difficult to correctly forecast the amount of transactions that can be expected on the IOTA network, we can give some level of estimation based on our experience in the market so far:

- There are an estimated ~2.5 billion consignments shipped across borders every year via ocean, air cargo, road, or rail.

- In our work with customers, we have tracked that each consignment will create an average of 26 transactions on the IOTA network. This includes the creation of the goods load records and updates, attachment of all relevant documents, and important journey events.

- If even a fraction of these ~2.5 billion consignments and the related documentation and certification are digitized, issued, and verified via IOTA, the transaction volumes become enormous. For example, just digitizing 1% of global trade documents implies 650 million transactions on the IOTA mainnet per year.

This means millions of daily IOTA transactions just from document issuance, updates, and transfers as global trade goes digital. That is not counting onchain actions related to digital identity, including issuance, updates, events for every actor in the supply chain, digital product passports for every individual item that gets shipped across borders, and all activities related to trade finance, including tokenization of assets and DeFi applications.

By first focusing on the digitization of trade, we embed IOTA deeply at the source of the flow of goods, creating a competitive moat as this data will only be accessible on the IOTA network. As governments and enterprises digitize their trade infrastructure through TWIN, every shipment, certificate, and invoice becomes an onchain record – creating the perfect foundation to tokenize the underlying assets.

This uniquely positions IOTA to lead the tokenization of physical commodities, critical minerals, and trade receivables. The global commodities market exceeds $20 trillion annually, encompassing energy, metals, and agricultural goods that move through millions of consignments every year. The critical minerals market is expanding rapidly, expected to surpass $325 billion annually as demand for lithium, cobalt, and rare earths accelerates.

Meanwhile, global trade receivables represent another $40–50 trillion in outstanding value, with a $2.5–3.5 trillion financing gap that tokenization can directly address.

Even capturing a small fraction of these flows would translate to billions in tokenized value that will be accessible in IOTA’s RealFi ecosystem.

Securing the Infrastructure: The $IOTA Economy

As outlined earlier, past attempts to digitalize global trade have repeatedly failed – primarily due to lack of neutrality, conflicts of interest, and profit-driven control by single actors. IOTA breaks this pattern. It is an open-source protocol, guided by a regulated non-profit foundation and designed from the ground up to be globally accessible, politically neutral, and economically inclusive. This neutrality and the security of the entire network is only possible through the $IOTA token.

With the Rebased protocol upgrade in May 2025, IOTA was rebuilt with a more robust, highly scalable and decentralized architecture. This marked a giant leap forward to make IOTA production-ready for large-scale deployments such as TWIN. The network is now fully decentralized and secured by a distributed validator set selected by $IOTA token holders. The more validators and the more value staked, the more resilient and secure the network becomes.

The IOTA token is the mechanism that makes the infrastructure decentralized, censorship-resistant, permissionless and resilient. Other than the most fundamental properties to ensure the immutability of the ledger and protect against large scale attacks, the $IOTA token guarantees the network's neutrality and independence. No single party is able to control or influence the network, as it would be economically and cryptographically infeasible to do so. This is exactly what governments and institutions require when adopting and relying on a shared global infrastructure.

For the network to function, it is paramount that there is a viable tokenomics model that underpins the value accrual and stability of the system. The IOTA token is the value unit within the IOTA network. Just as modern data centers are secured by electricity and GPUs, the IOTA token secures the IOTA network and ensures the network’s operation.

And just as investors in AWS believed in the future of cloud infrastructure and bought Amazon stock, believers in the future of open digital trade infrastructure can own a piece of the Digital Trade economy through the IOTA token. With nearly a decade of token distribution and no venture capital investors since our inception, IOTA has one of the most distributed token ownerships in the industry – making the system more inclusive, more resilient, and more aligned with its global mission.

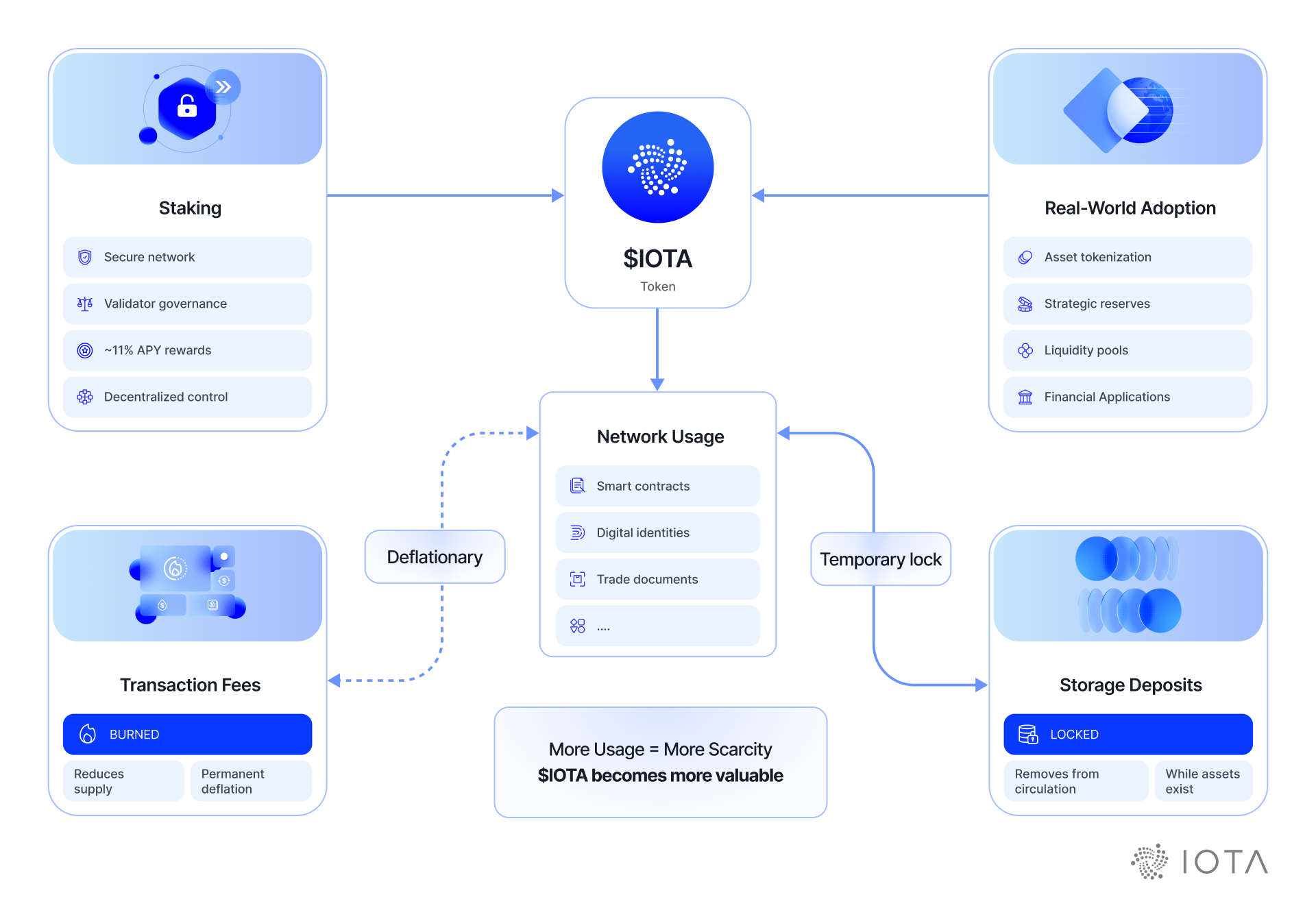

As adoption increases, so does demand for the token. Every new trade document, shipment tracking, digital identity, or tokenized asset on the network burns $IOTA tokens through transaction fees or locks it up via storage deposits. Unlike inflationary token models, IOTA’s economy is deflationary by design: the more the network is used, the fewer tokens remain in circulation. Over time, this creates a simple and powerful economic truth:

More usage = more scarcity = $IOTA becomes more valuable.

This value accrual is reinforced by multiple mechanisms within the IOTA network, each designed to secure the system, incentivize participation, and ensure that growth translates directly into real economic impact.

- Staking: The economic security of the network is largely based on the amount of tokens staked. Token holders collectively secure the network and delegate their voting power to validators, ensuring decentralized control and economic alignment. To incentivize this network validation, staking rewards are distributed daily. Today, $IOTA stakers can earn on average 11% APY for staking and securing the network.

- Transaction fees: All onchain activity – transactions, data, digital identity, smart contract computation, and tokenization – requires $IOTA to be paid and burned as fees.

- Storage Deposits: IOTA’s unique storage deposit mechanism means that using the network for assets actually removes tokens from circulation (temporarily or long-term). Whenever someone creates a new digital asset or record on the IOTA ledger – for example, tokenizing a bill of lading, warehouse receipt, or cargo asset – they must lock up a small amount of $IOTA as a “storage deposit”. If the asset/token is later deleted, the deposit is refunded to the owner, but as long as real-world assets remain digitized on IOTA, those tokens are effectively out of the circulating supply.

- DeFi Utility & Tokenization: IOTA underpins decentralized finance and real-world asset tokenization on the network. Tokenized trade assets, financial instruments, and digital representations of value rely on IOTA for verification, near-instant transactions and smart contract execution. As tokenized economic activity grows, demand for $IOTA increases through its role in settlement and asset lifecycle management.

- Governance: As IOTA’s adoption grows across sectors and continents, the token ensures that power remains distributed and incentives stay aligned. Token holders secure the network by staking and delegating to validators, preventing control by any single actor. This governance model guarantees neutrality, transparency, and long-term alignment.

- Enterprise accumulation: Enterprises and institutions building on IOTA are incentivized to hold $IOTA as strategic reserves to secure long-term access to network resources such as blockspace and storage, and to participate in the security of the network. As adoption increases, enterprise accumulation reduces circulating supply and strengthens economic security.

Combining all these factors – fee-burning usage, locked storage deposits, enterprise accumulation, and DeFi utility – it becomes clear that IOTA’s tokenomics model is engineered for deflationary pressure and value accrual as adoption grows. Every mechanism in the network’s economy either decreases the available supply or increases demand.

How IOTA Executes: Technology Stack

The adoption of IOTA in global trade is real. We can confidently say that IOTA is the biggest Blockchain solution to digitize trade. The reason for that is a more than five-year journey that started with a deep understanding of our users' needs and by working closely together with them on a technology stack and products to solve their problems.

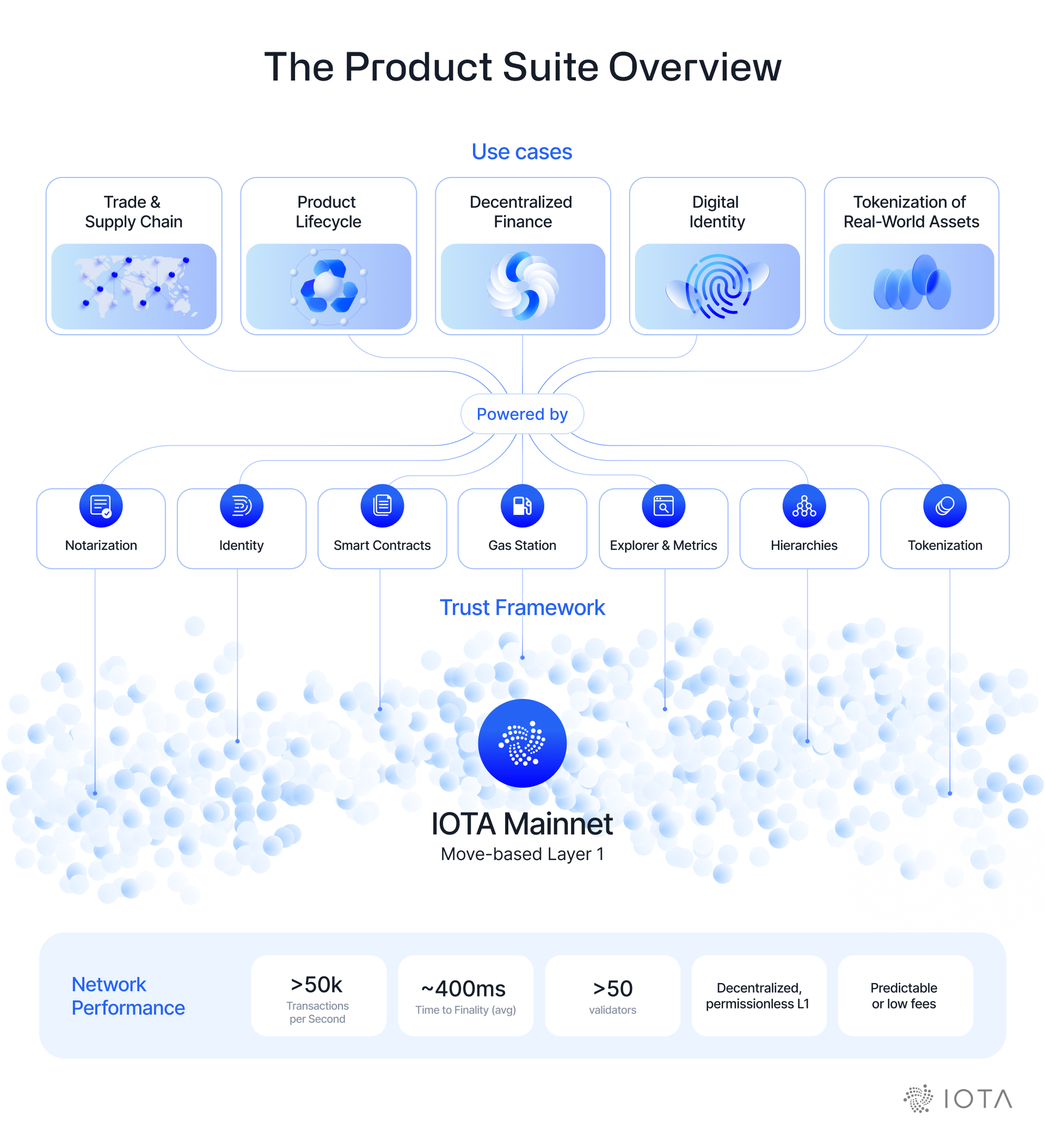

The technology stack offered by IOTA is purpose-built around the various enterprise use cases for IOTA, and specifically for trade:

- IOTA Tokenization enables the creation of digital representations of real-world assets such as trade documents, goods, or financial instruments. In trade, this allows ownership, collateral, and payment rights to be represented and transferred seamlessly across borders. By turning physical assets or claims into programmable tokens, settlement and financing processes become faster, more transparent, and automated. This helps remove intermediaries and manual, inefficient processes, unlocking liquidity and better financing in global trade networks.

- IOTA Identity provides decentralized identifiers and verifiable credentials that establish trust between trade participants, devices, and authorities. In global trade, it enables KYC/KYB-compliant onboarding of suppliers, buyers, and intermediaries, while allowing secure and selective data sharing. Customs authorities, inspection agencies, and banks can issue digital credentials that can be instantly verified onchain. This reduces fraud, simplifies compliance, and ensures that all participants in a trade flow are authenticated and accountable.

- IOTA Hierarchies defines structured relationships and delegated authorities among participants, such as between parent companies, subsidiaries, or certification bodies. In trade, this enables modeling of real-world governance – who can issue credentials, approve shipments, or sign trade documents. It provides a verifiable chain of delegation that reflects the complex structure of supply chains and regulatory oversight. This helps ensure that permissions, responsibilities, and authorizations in trade ecosystems are transparent and auditable.

- IOTA Notarization secures the integrity and timestamp of critical trade data (such as invoices, bills of lading, or certificates) by anchoring cryptographic proofs onchain. It ensures that documents cannot be tampered with and provides verifiable evidence of when and by whom they were created. In trade finance or customs processes, this creates trusted audit trails that support compliance and dispute resolution. The mechanism bridges offchain documentation with onchain trust, without exposing sensitive data publicly.

- IOTA Gas Station enables transaction fee sponsorship, allowing users to interact with onchain applications without holding tokens. In trade systems, this is key to usability, because participants like suppliers or logistics agents can submit documents or trigger transactions without dealing with gas fees. This ensures a frictionless adoption for non-crypto-native users and removes one of the biggest onboarding barriers for enterprise trade networks moving onto blockchain infrastructure.

To make this product suite more concrete, IOTA provides a Digital Product Passport demo that brings the Trust Framework to life, allowing users to see identities, credentials, and onchain data flows in action through an interactive walkthrough.

Coalition and Governance

But it’s not just about technology or tokenomics. IOTA’s trade breakthrough also lies in its governance model, especially around TWIN. Unlike private, venture-backed products, TWIN is open-source and governed by the Swiss-based, non-profit TWIN Foundation. This structure ensures neutrality, transparency, and long-term commitment – qualities that make governments and enterprises far more confident to adopt and integrate the technology at scale. Combined with IOTA, TWIN is not a commercial product, but it is a public goods digital infrastructure designed to serve the global economy as a whole.

And we're not doing this alone. From the outset of our trade initiative, we knew that solving the global, systemic challenges of digitalizing trade would require a coalition of stakeholders. That’s why we’ve created strategic partnerships with some of the world’s leading organizations in trade and development.

This global alliance not only validates and adds credibility to our efforts and technologies, but it also accelerates our adoption with governments and industry.

- Tony Blair Institute for Global Change (TBI): Founded by former UK Prime Minister Sir Tony Blair, TBI is a major partner advancing trade digitalization through on-the-ground government programs across Africa and Asia. In October 2024, TBI co-authored Unlocking Africa’s Trade Potential, introducing TWIN as “an innovative digital infrastructure capable of streamlining trade” across Africa. Sir Tony has publicly endorsed TWIN, highlighting the role of blockchain in replacing paper-based trade processes. TBI’s backing gives us high-level access and credibility with governments globally.

- TradeMark Africa (TMA): A non-profit funded by development agencies to reduce trade barriers, TMA has deep expertise in border posts, customs modernization, and trade logistics in countries like Kenya, Rwanda, Uganda, and beyond. TMA co-founded the TWIN Foundation and initiated TLIP, bringing a network of customs authorities and regional economic communities and enabling IOTA’s tech to be tailored to real trade procedures. Demonstrations include cross-border digital verification of government-issued certificates via IOTA – a process that used to require couriers and weeks of waiting.

- World Economic Forum (WEF): The WEF has been a key convener of our trade efforts on the global stage. In late 2023, IOTA joined the WEF’s TradeTech Initiative, followed by a formalized partnership in early 2024. At the World Trade Organization’s 13th Ministerial Conference in Abu Dhabi, the WEF, IOTA, TBI, TMA, the Institute of Export & International Trade, and the Global Alliance for Trade Facilitation, signed a Collaboration Agreement to jointly develop and govern TWIN. The WEF’s involvement not only amplifies our message but also adds greater credibility and reach with governments and key decision makers around the world.

- The Chartered Institute of Export & International Trade (CIOE&IT): This UK-based authority on trade policy and training brings private sector expertise (exporters, freight forwarders, customs brokers, etc.). As a signatory to the WTO MC13 agreement, CIOE&IT helps bridge the gap between cutting-edge technology and everyday business use, helping ensure TWIN is neutral, inclusive, and solves the pain points of traders. For example, CIOE&IT has advised on the design of digital Certificates of Origin to ensure acceptance by both businesses and customs authorities. This practical orientation increases the likelihood of adoption in places like the UK and Commonwealth countries.

- Global Alliance for Trade Facilitation (GATF): GATF is an initiative that pursues a public-private partnership approach to trade reform, supporting low and middle-income countries in streamlining trade-related processes to move goods across their borders as quickly, safely, and cost-effectively as possible. By joining our coalition, GATF helps scale solutions and ensures interoperability between IOTA and other initiatives (for example, e-invoicing in Vietnam or digitizing phytosanitary certificates across Africa). GATF’s presence also signals policy alignment to governments and helps channel donor funding and technical assistance into TWIN deployments country by country.

Each partner adds tremendous value to the partnership, like government access, regional know-how, policy influence, or industry expertise, creating a virtuous cycle that no other crypto project could achieve. They mean that governments are more likely to approve a pilot, and that successful pilots can convert into national rollouts backed by development financing. They also create network effects; if a country adopts IOTA for trade, its major trading partners are nudged to join the same network to maximize efficiency. We’ve effectively positioned IOTA at the center of an influential group that is driving trade digitalization globally, giving us a seat at the table for developments on the future of trade tech. This kind of credibility is incredibly hard to replicate and gives IOTA a moat that goes beyond technical development.

Conclusion: From Trade to the Global Economy

After a decade of building, IOTA stands at an inflection point. While others have chased speculative narratives, we’ve focused on becoming a partner for governments and enterprises and working together with them to solve their problems. We have created a purpose-built product stack to holistically digitalize trade, create and manage digital identities, tokenize assets and streamline payments. Our network already processes real trade transactions in Kenya and the UK, with five more countries preparing to join the network this year. The network effects are real, and will only increase as more countries join the IOTA network.

The endgame is clear: IOTA becomes the trust layer for the global economy. Not through hype or artificial incentives, but through solving real problems for real businesses and governments. When millions of companies need to prove the authenticity of their goods, verify their trading partners, or access instant trade financing, they won't care about blockchain tribalism – they'll use what works. And what works is a neutral, open-source network that their governments trust, their banks accept, and their trading partners are already using.

This creates a powerful flywheel: Every country that adopts IOTA makes the network more valuable for its trading partners. Every tokenized shipment creates collateral for new financial products. Every verified credential builds trust that enables more commerce. As this real economic activity flows through IOTA, the network transforms from infrastructure into necessity – becoming as essential to global trade as container ships, GPS or the internet itself.

We have not built yet another Blockchain. We're building the foundation for how trillions in value will move in a digital world. The partnerships are in place. The technology is proven. The adoption is happening.

Welcome to the digital economy, onchain with IOTA.

Join us.